The rise of global electric vehicle (EV) consumption is driving the carnival of the automotive industry and stimulating the development of the whole upstream industry chain, especially the copper industry. It is indispensable in all kinds of energy technologies, especially in the most eye-catching field, the electric vehicle industry. The boom in global electric vehicles will have a significant impact on copper mines.

Electric vehicle

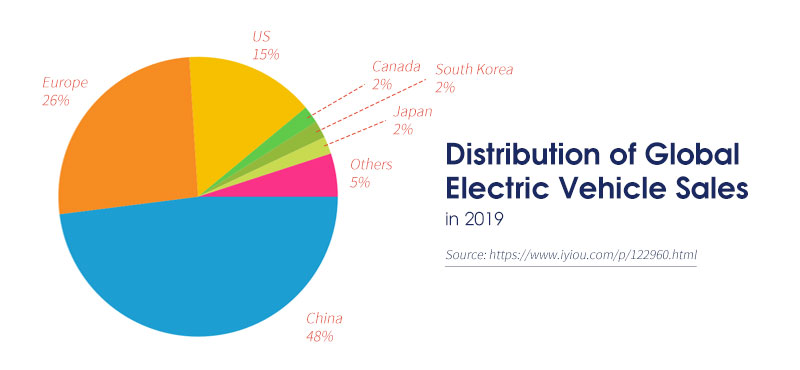

How about global electric vehicle sales in 2019?

According to the latest data released by EV Sales Blog on February 3, 2020, global sales of plug-in hybrid electric vehicles (including battery electric vehicles) in 2019 reached 2.21 million units, up 10% from 2018. Electric vehicles accounted for 2.5 percent of the market, an increase of 0.4 percentage points from 2.1 percent in 2018, meaning that for every 40 cars sold, there is one electric car.

The electric vehicle market is mainly distributed in China, Europe and the United States, which will be described in detail below.

Distribution of Global Electric Vehicle Sales in 2019

China:

China sold 1.06 million electric vehicles in 2019, accounting for 48% of global EV sales and 5.5% of global car sales, higher than that of the U.S. and Europe.

| Year | Market shares |

| 2018 | 4.5% |

| 2019 | 5.5% |

| 2020E | 5% - 6% |

Europe:

Electric vehicle sales in Europe have grown strongly. Its market share has risen to 3.8%.

| Year | Sales ('000 sales) |

| 2018 | 407 |

| 2019 | 579 |

| 2020E | 1000 |

The United States:

In 2019, sales of electric vehicles in the United States dropped by 32,000 units, a decline of 8.9%. The market share of EVs in the United States fell from 2.1% to 1.9%.

In addition to the three major markets, it is estimated that the total sales of EVs in Canada, Japan, and South Korea are slightly higher than 130,000. Overall, electric vehicle sales have generally increased in 2019.

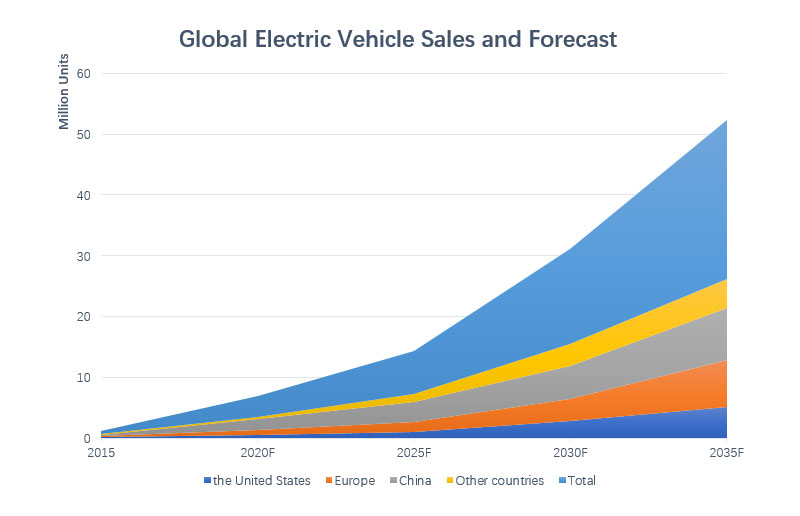

What is the trend of the global electric vehicle market?

Electrification is the main development direction of the automobile industry and the historic transformation of the automobile industry is unfolding before our eyes. The next 15 years will witness the strongest growth in the EV market due to:

- 1 National policy: purchase incentive measures

- 2 Environmental protection requirements

- 3 Diversified energy structure of electric vehicles

- 4 Cheaper batteries with the expanded capacity

- 5 Rapidly developing charging infrastructure in cities.

Global Electric Vehicle Sales and Forecast

Industry analysts predict that the total sales of the automotive market will continue to decline, but the EV market will continue to grow and the global EV market share is expected to exceed 3% in 2020. Research shows that by 2040, more than half of all new vehicles will be electric vehicles.

How does the electric vehicle market affect copper demand?

Copper is an essential choice for electric vehicles and their required infrastructure due to the following attributes:

- Copper has almost the same conductivity as silver (the most conductive metal) and is not affected by temperature.

- Copper can be easily molded into wires, which is important for electric cars.

- It has a low cost.

- It cannot be replaced by any other metal.

Copper: an essential choice for electric vehicles

Therefore, copper is crucial to the electric vehicle industry. The popularity of electric vehicles will also inevitably lead to a significant increase in copper demand, which may become an important driving force for copper demand in the near future. Citibank said that in the long run, copper demand for EVs will account for two-thirds of the increase in copper demand from 2018 to 2030.

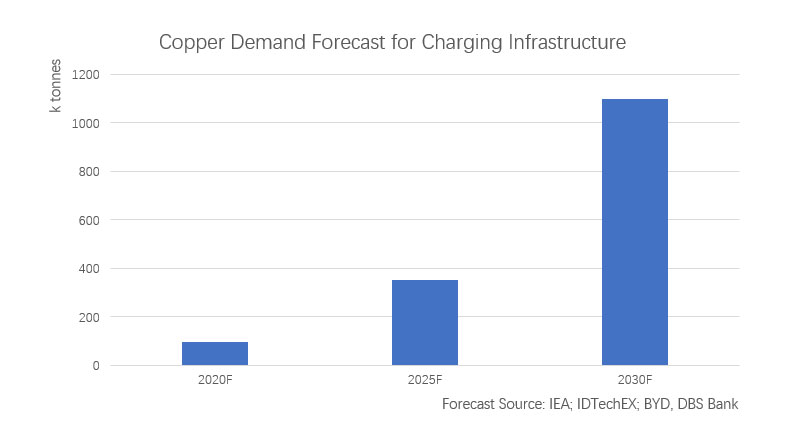

Increased demand for copper in infrastructure

With the advancement of technology, it is expected that the demand for electric vehicles will surge over the next decade, the price difference between electric vehicles and gasoline-powered vehicles will disappear and more charging piles will be installed, said Franco Gonzalez, senior technology analyst at IDTechEx.

Analysts at BMO Capital Markets also pointed out that charging stations, grid infrastructure and other related infrastructure, rather than electric vehicles themselves, are the first to affect global copper demand.

Charging piles of electric vehicles

As technology advances and infrastructure capacity increases, more electric vehicle infrastructure will emerge around the world. ChargePoint, one of the world's largest manufacturers of public charging stations, aims to increase its global network of charging stations 50-fold by the mid-2020s, so the demand for copper will continue to increase. The following graph shows the copper demand forecast for charging infrastructure over the next decade:

Copper Demand Forecast for Charging Infrastructure

Wood Mackenzie also said that by 2030, electric vehicle charging piles would exceed 20 million and copper consumption would be more than 250% higher than in 2019.

Increased demand for copper in electric vehicles

According to Copper.org research, the use of copper has increased dramatically from gasoline-powered vehicles to pure electric vehicles. From the batteries, windings and rotors of electric motors, to inverters and wires, large amounts of copper are used in the main components of electric vehicles. Each electric car requires 2-4 times the copper consumption of traditional cars with internal combustion engines (ICEs). The following is the amount of copper used in different types of cars:

| Types | Copper consumption (kg) |

| Internal combustion engines (ICE) | 23 |

| Hybrid Electric Vehicle (Hybrid) | 40 |

| Plug-in hybrid electric vehicles (PHEV) | 60 |

| Battery electric Vehicle (BEV) | 83 |

| Electric bus | 224 - 369 |

According to data from the International Copper Association, global demand for copper in the new-energy automotive industry will increase more than nine-fold from 2017 to 2027.

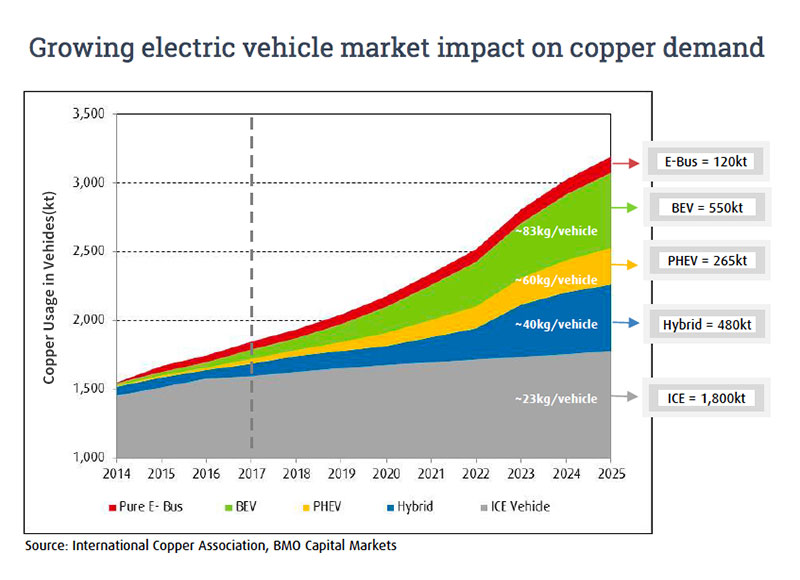

BMO Capital Markets also made predictions on the demand for copper mines for electric vehicles:

Growing electric vehicle market impact on copper demand

BMO Capital Markets forecasts that demand for electric vehicles will reach 3.32 million tonnes of copper by 2025.

According to BMO, we could face a supply deficit of 900,000 tons by 2022. This is due to a lack of new copper discoveries, high exploration costs and the decline in ore grades in major copper-producing countries such as Australia, Chile and Peru. If this situation does not improve, we will face a severe supply shortage.

Conclusion

Copper will play an increasingly important role as the world continues to move towards sustainable development and energy. It is an irreplaceable metal in electric vehicles and the rapid development of the electric vehicle industry will significantly boost the demand for copper in the next decade.